With the difficult year of 2020 behind us, the Cook Family Foundation is pleased to announce $90,959 in grants to Shiawassee nonprofit organizations to help them finish the year in the best position to survive and thrive in 2021. These grants were in addition to $43,042 in COVID-related emergency grants earlier this year.

“It has been a tough year for local nonprofits, just as it has been for our small businesses” said Tom Cook, Executive Director of the Cook Family Foundation. “We knew that helping them out would help out our community. We know many people have given extra to local nonprofits this year, and we wanted to do our part.”

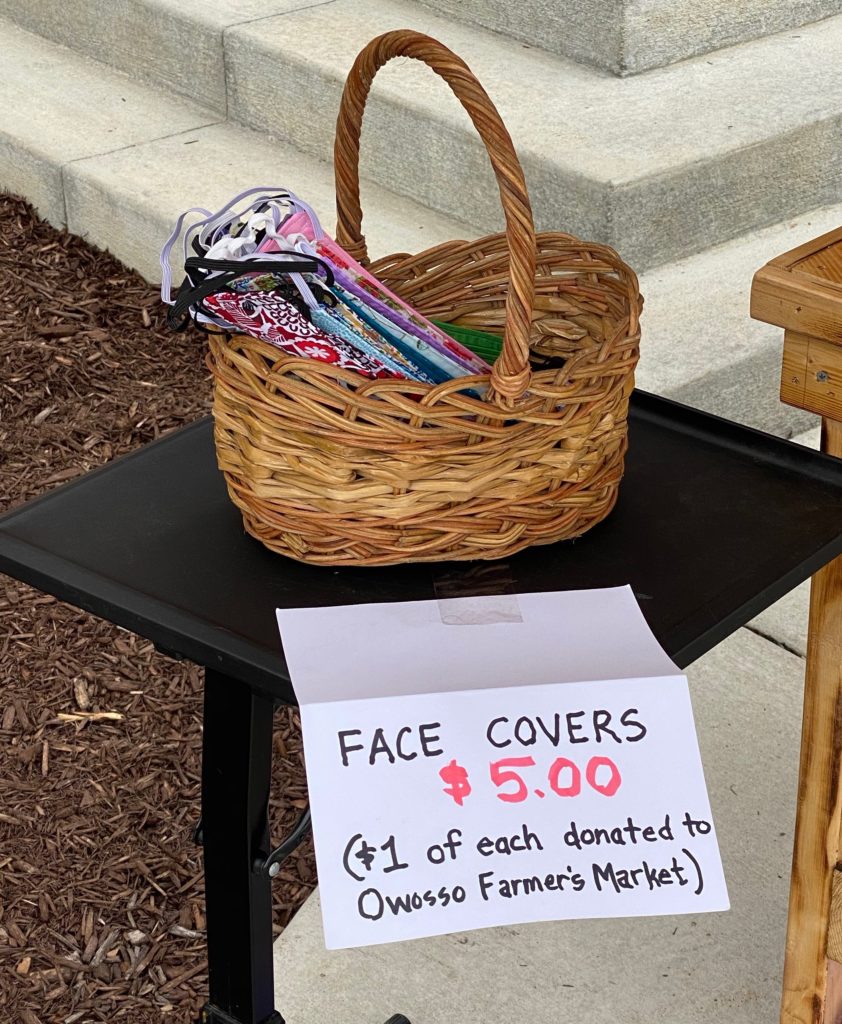

The grants, averaging about $7,000 each, were given to 15 local nonprofits and the Genesee United Way which serves Shiawassee County. The first grants in March and April helped several nonprofits respond to pressing community needs; an additional $15,000 was provided to the United Way to help address the health and economic emergency. “Several community groups serve those in need, and we wanted to help them provide food, personal protection equipment (PPE), and other support,” said Cook. Grants were made to Respite Volunteers of Shiawassee, the Arc of Mid-Michigan, the Downtown Owosso Farmer’s Market, and Durand Union Station.

“We were particularly proud to support the initiative of the Durand Union Station,” Cook commented in noting how the railroad history center helped organize volunteers to make masks, used their facility as a drop-off site, and worked with others to distribute masks and other PPE to those who could not access them. “This is the kind of commitment and creativity we see from our local nonprofits all the time.”

The latest set of grants were designed to help nonprofits make investments that would enable them to finish out the year strong and prepare to thrive in 2021. Those receiving grants included:

- Arc Mid-Michigan to directly assist students and adults with developmental disabilities;

- DeVries Nature Conservancy to make up for several cancelled fundraising events;

- Friends of the Shiawassee River to expand virtual and online educational offerings for students;

- Girls on the Run to overcome COVID-related difficulties in providing empowerment programs;

- Lebowsky Center for the Performing Arts to make technology upgrades;

- Shiawassee Arts Center to continue their partnership with the Shiawassee Council on Aging to provide art activities for seniors in their residences;

- SafeCenter to help manage the delays and difficult accounting of federal grant programs;

- Shiawassee Family YMCA to serve as a community hub for food distribution and programming;

- Shiawassee Humane Society to draw up plans for facility upgrades;

- Shiawassee Regional Chamber to support memberships for local nonprofits;

- Voices for Children for operating costs and building improvements.

All of the nonprofits receiving grants serve Shiawassee County residents, and many have deep roots in the community. “Our region has a tremendous group of nonprofits with active volunteers and committed board members,” observed Tom Cook, “They add greatly to the strength of our community and the quality of life for all of us.”

The Cook Family Foundation operates a Nonprofit Capacity Building program which provides consulting advice, technical assistance, training, and strategic planning to Shiawassee-based nonprofits. “I would like to give special recognition to the Executive Directors and other nonprofit staff who have not only survived 2020, but have found ways to advance the mission of their organization in very difficult circumstances.” To help nonprofits grow in expertise, efficiency, and effectiveness, the Foundation offers regular workshops and gatherings of local board members and staff. See our Events page for upcoming trainings and networking sessions.

The Cook Family Foundation was established in 1979 by Donald and Florence-etta Cook to serve as both a resource for the Shiawassee region and a catalyst for positive change. The Foundation also invests in educational programs and provides scholarships for area students to attend the University of Michigan.